In today’s world, there are countless payment options. For instance, when we go to a shopping store we all have the option to pay with a credit card, and sometimes we have another payment option that is special to the store.

Let’s take Starbucks as an example, when I go to a Starbucks coffee shop I have two basic electronic payment options, the first one is obviously my credit card and the second one is paying with the Starbucks mobile application. But if I decided to go to a different branded coffee shop, I won’t have the option to pay with Starbucks mobile application anymore, but I would still have the option to pay with a credit card.

In the Fintech world paying with a credit card refers to open-loop payment method and paying with the Starbucks application (which is only valid in Starbucks coffee shops) refers to closed-loop payment method.

In this article, I hopefully try to explain the open-loop and closed-loop payment methods.

Open-Loop Payment Methods

Open-loop payment methods are the most common payment methods around the world. Where closed-loop payment methods are limited in scope open-loop payment methods are widely accepted. They consist of traditional credit cards, debit cards, mobile applications, open wallets that are issued by banks, or institutions that are cooperating with banks, such as Google Wallet, Square Wallet, MasterPass, and so on.

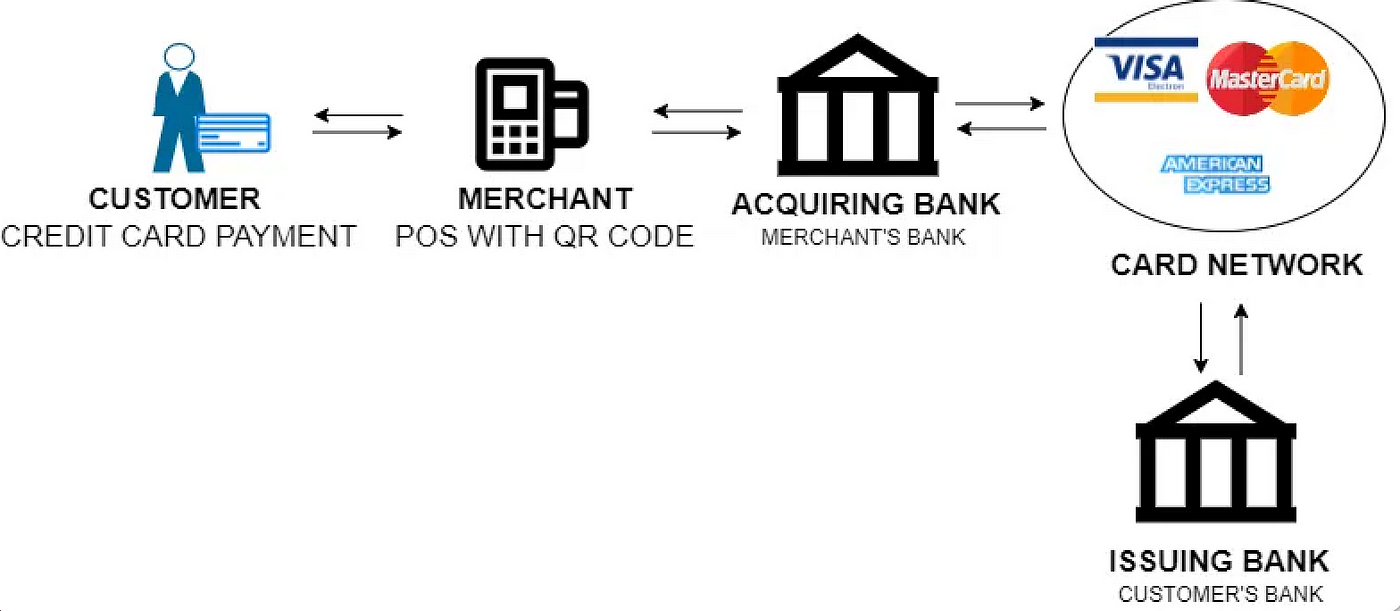

Let’s go back to our first Starbucks example. Say you took the first option and decided to pay for your coffee with a credit card, which is considered an open-loop payment method. Let’s take a look at how it works from a high level.

Demonstration Of How It Works

As the diagram shows, right after the customer pays with his/her credit card, POS sends the transaction to the merchant’s bank. After that, acquiring bank redirects the transaction to the card network then the network sends the transaction to the issuer bank for approval. Note that the card network acts as an intermediate between banks.

This flow is called authentication, to make sure the customer has sufficient balance and other important fraud checks are done. If they are all approved then the Issuer bank freezes the requested money in the customer’s bank account.

The second flow is called the settlement, which happens in the same order as the authentication flow. It typically takes place, at the end of the day in which transactions are sent as a batch to the Merchant’s bank account.

More Adopted Around The World

Open-loop payment methods are more adopted than closed-loop payment as they aren’t specific to a single brand or business. Many businesses accept open-loop payment methods, which can range from POS purchases to e-commerce transactions to mobile payments.

Easy To Use

Open-loop payment methods are typically easy to use and customer friendly moreover since their customer support system is more established when customers experience a technical problem using these methods they can get customer support quickly.

Cons Of Open-Payment Methods

Open-loop payment methods are typically more expensive to manage. When a company develops an open-loop payment solution it is generally slower to enter to market than a closed-loop payment solution.

Closed-Loop Payment Methods

Closed-loop payment methods offer payment solutions issued through the business itself. These payment solutions can be a gift card, a preloaded physical card, or a mobile application that is specific to a business or a brand.

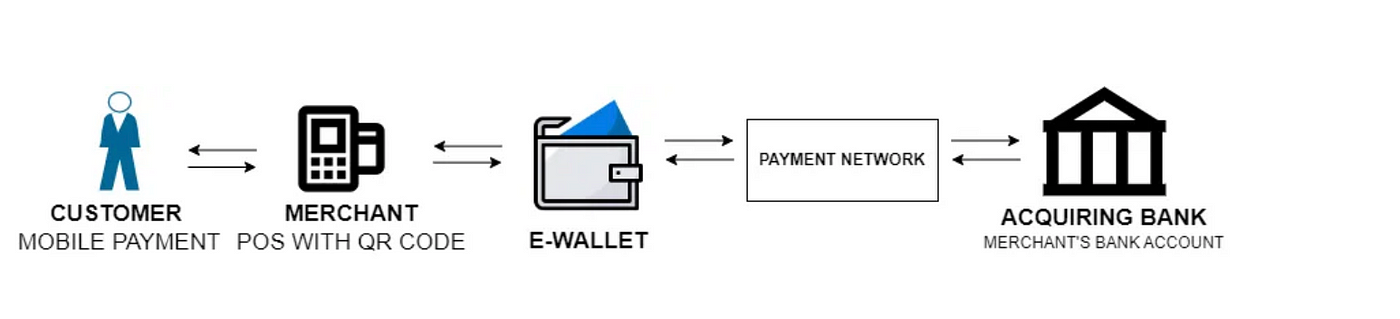

Let’s go back to the original Starbucks example. Say you took the second option and decided to pay for your coffee with the Starbucks e-wallet from your mobile application, using QR technology. Let’s take a look at how it works from a high level.

As you can see POS device sends acquiring bank information and other necessary information to the e-wallet. In that case, an e-wallet is an alternative payment method. And it uses a payment network to connect to acquiring bank’s virtual pos. Note that just like an open-loop payment system, it also has authorization and settlement flow which happens in the same order.

Also, note that since the issuer side is Starbucks e-wallet there is no issuer bank like the open-loop system has.

Financially lucrative

Typically closed-loop payments cost less money to businesses as the commission that credit cart takes goes away. In addition to that, since customers have to use these payment methods inside the specific business, the business is guaranteed to make a profit.

More loyal customers

These businesses generally give loyalty credits to their customers which can be spent on their stores which can make customers more loyal to them. It can be beneficial for customers since they get free loyalty credits for their favorite brand.

Challenges with closed-loop payment methods

Even though closed-loop payment methods are usually win-win for merchants and customers, many customers find it limiting as they can be only used for specific places. And they could find it difficult to get used to it since they are used to paying in a certain way.

Similarities Between These Payment Methods

These two payment methods can be very similar, for instance, closed-loop and open-loop payment methods can be in form of paying with a mobile application. They can be in credit card forms as well, with the exception that open-loop payment cards are typically issued by major financial organizations such as Visa, MasterCard, AmericanExpress, and so forth.

More Options Are Better

Payment options are important and customers do care about them. So it is important for a business to keep payment options as broad as possible, enabling the ability to pay with major open-loop payment methods and also creating closed-loop payment methods and trying to make customers loyal to them with loyalty programs.