“All I want for Christmas is a 175mm Rohrzange (pipe wrench),” said no FinTech founder ever.

But when it’s dipped into gold and comes with a FTGA title, the Rohrzange might create a substantial thrill in the Fintech world. That’s precisely what happened on December 11th; FinTech founders were buzzing with excitement to learn about the recipients of the FTGA Rohrzange at the Microsoft building in Berlin, and I was there to observe the energy.

Since 2016, the Fintech Germany Award has been awarded annually to leading start-up and scaleup companies in the finance universe. Initially kicking off as a German-speaking event in Frankfurt, FTGA switched to English and moved to Berlin a couple of years ago to become more inclusive and welcoming.

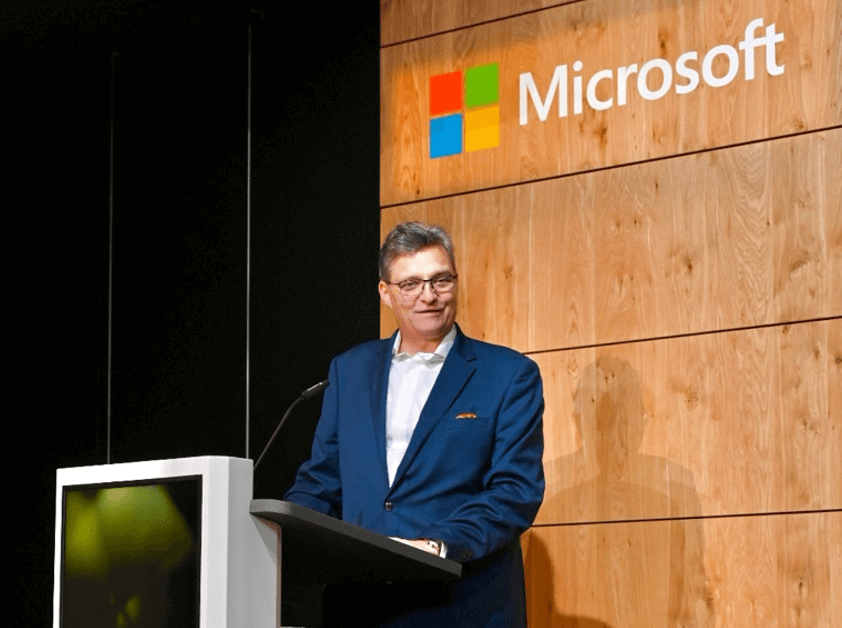

“German is not inclusive, especially when you look at FinTech,” said Michael Mellinghoff, the Co-Initiator of the Fintech Germany Award, during his opening speech. “We want to support start-ups by giving them access to the English-language world, and that’s why I fought long and hard to make it in English,” Mellinghoff added. Indeed, the Microsoft auditorium filled with founders from Sweden to Israel reflected the diversity goal that was achieved.

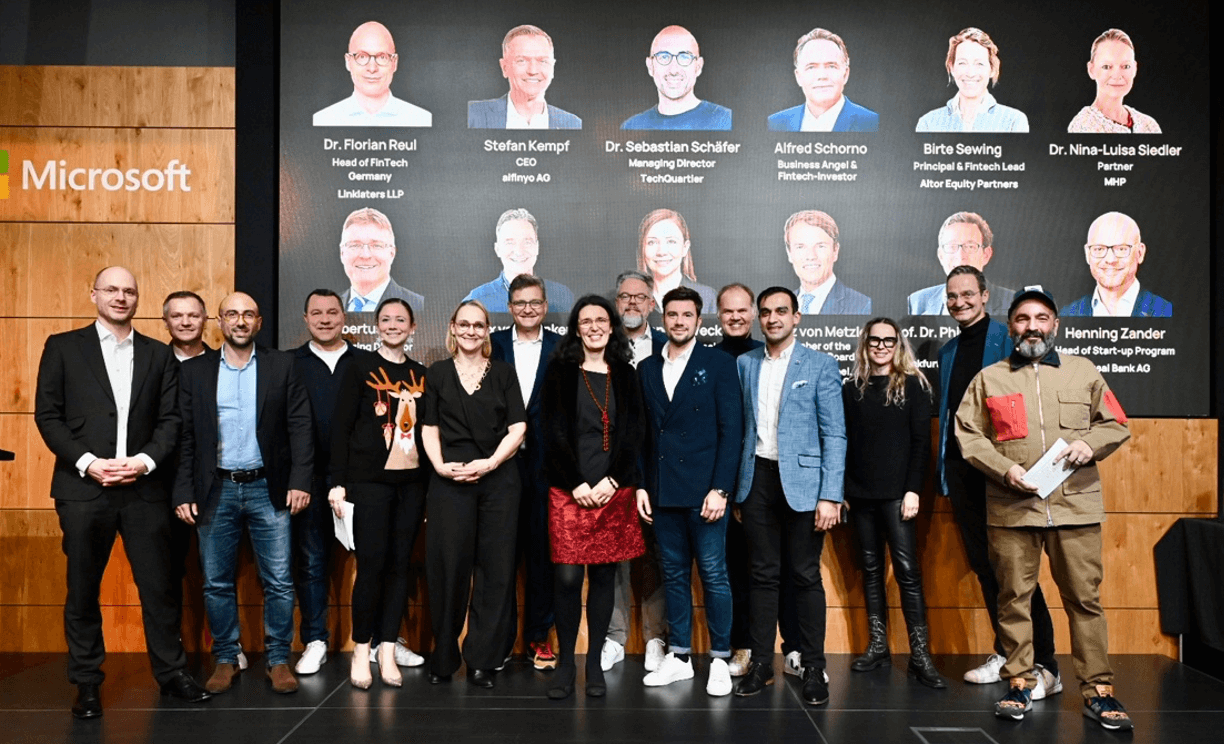

The event was co-hosted by Alexandra Weck and Nektarios Liolios and brought together traditional bankers and techies, bridging the old and new in the finance world. Let’s look at the highlights of the ceremony before announcing the winners.

Highlights of the 8th Fintech Germany Award

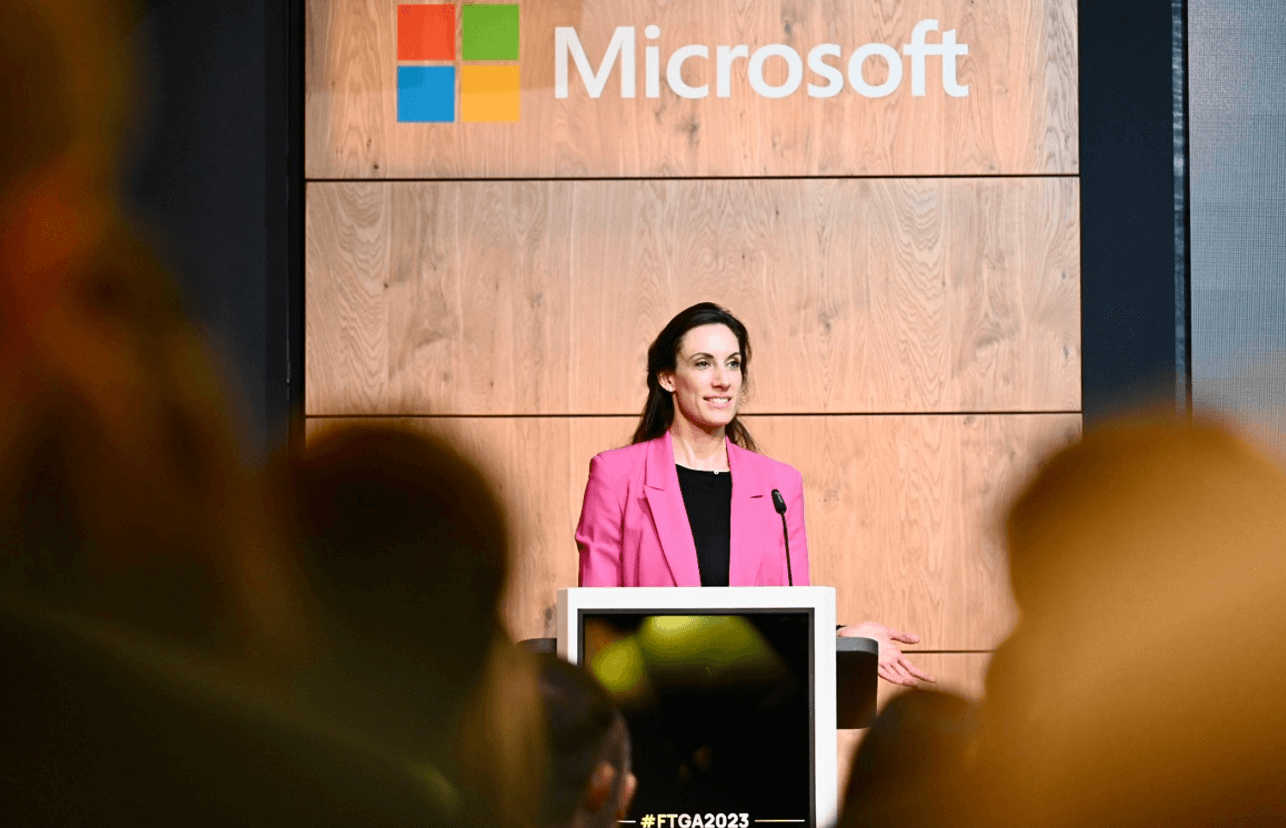

The event started with Dr. Jennifer Pernau of Microsoft welcoming the attendees. In her speech, Dr. Pernau celebrated ChatGPT’s first birthday (November 30th), highlighting its significance for financial services. According to Dr. Pernau, AI is already transforming finance and will be used for hyper-personalization and create added value in financial services.

FTGA continued with the Jury acknowledging the hardships of 2023. “2023 was a really hard year. It wasn’t easy. Things that worked in the past didn’t work anymore. Investors behaved weirdly; the market behaved weirdly. It’s been hard for everybody,” admitted Nektarios Liolios and invited all the attendees for a round of applause for the companies who made it through the year and their families that supported them.

Afterward, Stefan Evers, The Mayor and Senator for Finance of the state of Berlin, was invited to the stage and talked about the significance of Berlin for the FinTech world. For Evers, although Frankfurt is considered the financial center in Germany, Berlin has the unique conditions to create notable FinTech start-ups. Although a big majority of all German FinTechs are already in Berlin, the number is likely to increase due to the planned launch of the Berlin House of Finance and Tech in 2024.

Evans concluded by sharing the political plans to position Berlin as the leading digital financial center. Later, Nick Alexander OBE, Counsellor, Global and Economic Issues at the British Embassy, “slammed” these plans and predictions while accepting the award on behalf of a British start-up. “Excellent news about the strength of the FinTech sector in Germany. However, I have to say that one of the few areas where the UK is slightly ahead of Germany is in this particular sector. While Frankfurt is indeed very nice, and Berlin is very cool, you know where it’s happening, and it’s the UK.”

Tamaz Georgadze, the CEO of Raisin GmbH, one of Germany’s most successful FinTechs, followed Evans, revealing the change in the FinTech ecosystem during his keynote speech. “We started Raisin eleven years ago. There weren’t too many startups, not too much capital back then. In time, low rates enabled an enormous capital. However, after the boom, a bust was expected,” said Georgadze, and added, “FinTech was often described as David vs. Goliath. The truth is always in the middle. So far, it looks like David is defeated. The biggest startups nowadays have millions of customers, which wasn’t the case back then. Nowadays, the ecosystem is more reliable and scalable, so it really works.”

According to Georgadze, a current account relationship lasts longer than an average marriage, so you better pay attention to your FinTech providers!

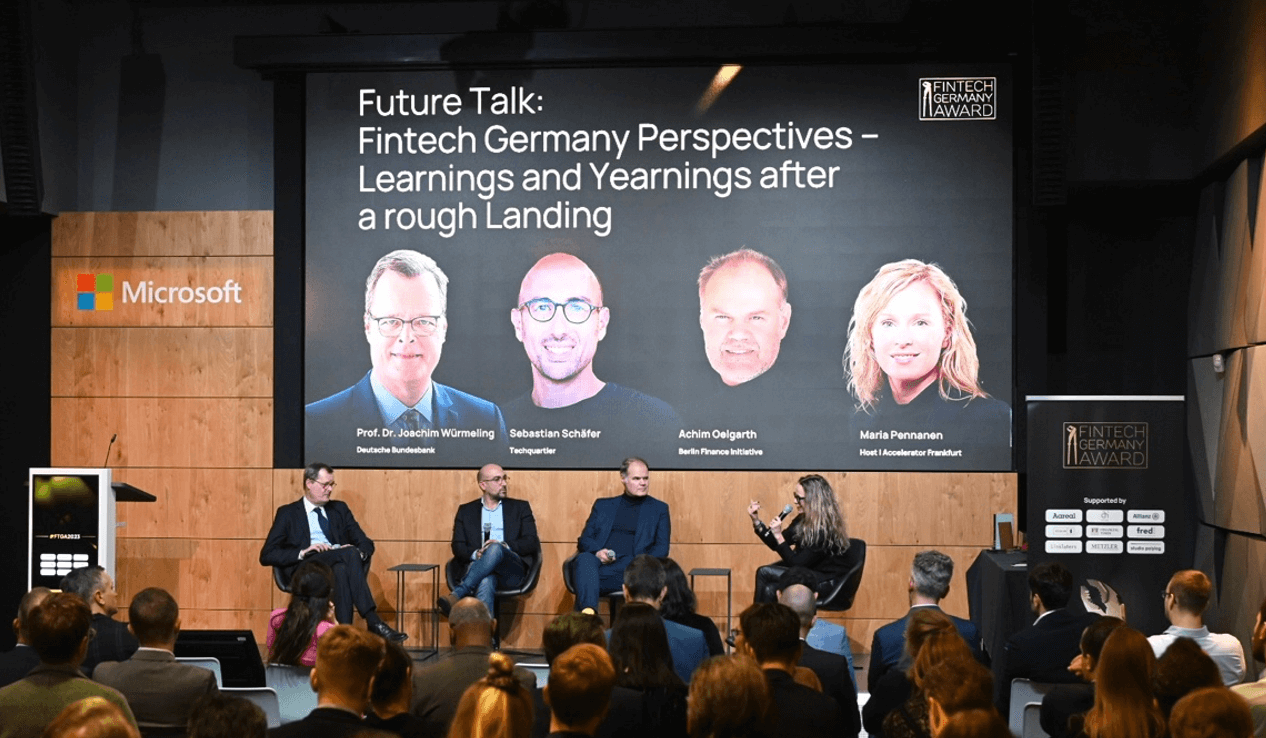

The FinTech panel, including Prof. Dr. Joachim Wuermeling (Bundesbank), Achim Oelgarth (Berlin Finance Initiative), Dr. Sebastian Schäfer (TechQuartier) and moderated by Maria Pennanen (Accelerator Frankfurt) focused on the future of FinTech. Maria Pennanen started with a fiery question: “Is AI or quantum computing a threat or opportunity for the Bundesbank and the banks in Germany?” According to Prof. Wuermeling, the Bundesbank is a very tech-oriented authority and already invested a lot in these technologies, as “you have to start now to reach quantum readiness when the time comes.” It turns out that Bundesbank already found thirty use cases for quantum computing and is already working with start-ups.

According to Achim Oelgarth, although AI is quite old, only a few start-ups use deep tech models on AI. “First, we must do AI just and right, and in the meantime, we have to dig deeper into quantum computing and see what kind of use cases exist for the financial sector. However, investing in quantum computing as a start-up is not so easy,” added Oelgarth.

In the end, panelists established that although there were hardships in the sector, it’s only normal that the industry is going through a correction, and this will allow the smaller companies to merge with stronger ones. The panelists’ glasses are full for next year, quoting Achim Oelgarth, “If you have the vision, you’ll find the money.”

Fintech Germany Award Winners

The event awarded FinTech founders in eight categories, deep-diving into candidates’ business models, tech infrastructure, and market value. Here are all the winners of FTGA2023:

Seed Stage FinTech Award:

1st Place: fin:marie

2nd Place: DIVIZEND

3rd Place: artificient

Berlin-based fin:marie empowers women to reach their financial goals with a full-female founder team. This is a well-deserved award, according to Alex von Frankenberg, the MD of High-Tech Gründerfonds, as there is a severe financial literacy gap in Germany, and fin:marie is addressing this problem with personalized financial education and wealth management offers.

Early Stage FinTech Award:

1st Place: ICO-LUX

2nd Place: Wealthpilot

3rd Place: elucidate

Jena-based ICO-LUX does automated document processing, helping large companies such as banks and insurance companies to work cost-efficiently.

Late/Growth Stage FinTech Award:

1st Place: Upvest

2nd Place: Moonfare & TANGANY

The Late/Growth Stage FinTech Award winner Upvest pivoted successfully two years ago to an Investment-as-a-Service model and has closed numerous impressive partnerships in 2023, including N26 and Raisin. Tobias Auferoth, the MD/CFO of Upvest (and my former FinLeap roommate), accepted the award on behalf of the team.

Most Promising International Start-up in Germany:

1st Place: Climate X & Qonto

3rd Place: Anyfin

Climate X helps organizations “become more resilient to the impacts of climate change by quantifying, at an asset level, the probability and severity of weather events decades before they happen.” They did not receive the award in person to protect the climate.

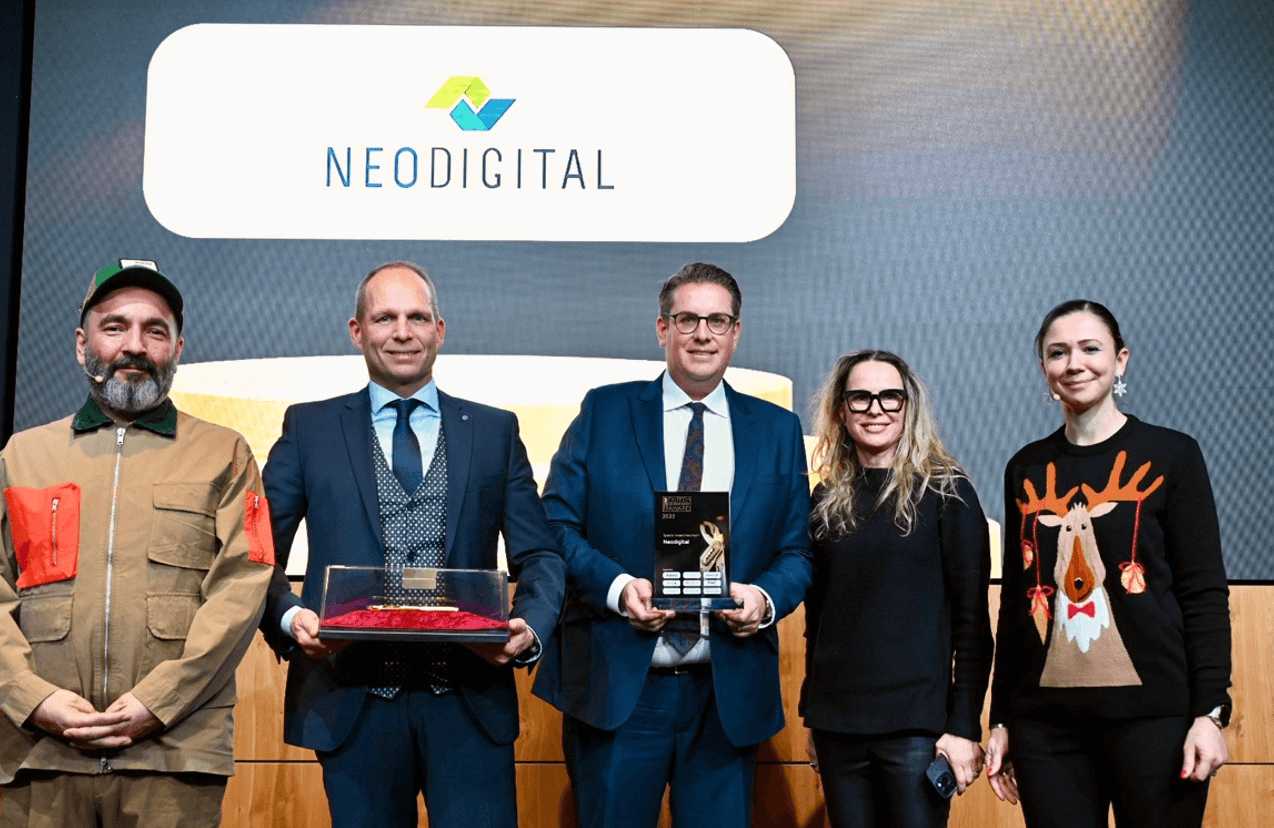

Special Award: InsurTech

NEODIGITAL

NEODIGITAL offers insurance-as-a-service and promotes 100% remote work. According to Maria Paennen, the five elements of start-up success depend on the founders’ experience, ability to build trust, a strong product, scalability, good people & retention and NEODIGITAL ticks all the boxes.

Special Award: AI

HAWK: AI

HAWK:AI solves compliance and AML problems using AI.

Special Award: PropTech

PriceHubble

PriceHubble operates a property valuation software for real estate professionals.

Michael Mellinghoff, the Co-Initiator of the Fintech Germany Award, shared a final message with me after the outstanding ceremony session: “Although the event is sponsor-driven, it’s also independent and inclusive. We would like to welcome founders from various origins. This structure ensures a certain stability, diversity, and quality. In the next years, we also aim to make the jury more diverse.”

You can watch the live stream via LinkedIn.