The complete text of the article entitled ‘The First Half of 2025: The Impact of Artificial Intelligence on Financial Services’, authored by Engin Çağlar, Founder of Context Elite Project and Strategy Consultant at OldSchool GmbH.

Executive Summary

- AI has moved from pilot programs to core infrastructure, fundamentally reshaping how financial institutions work.

- Data ownership and quality are the new battlegrounds for competitive advantage, with domain-specific datasets powering advanced models.

- AI delivers measurable ROI: massive fraud reduction, more equitable credit decisions, and dramatic process automation.

- The biggest shift is structural as organizations reorganize around intelligent capabilities instead of traditional departments.

- Introduction: 2025 as a Turning Point

The first half of 2025 marks a watershed for finance and AI. No longer an emerging trend, AI is now the engine behind digital transformation, from how risks are assessed to how customers are engaged. As regulators offer clearer guidance and ecosystems mature, leading financial institutions are accelerating adoption to unlock billions in productivity, security, and growth.

- From Pilots to Backbone: Rebuilding Financial Organizations Around AI

The biggest transformation in finance now occurs within organizational structures, not only customer-facing apps or trading floors. Banks and fintech companies are simplifying hierarchies, embedding AI into daily workflows, and rethinking core roles.

- JPMorgan’s AI-driven fraud detection scales to billions of transactions.

- Goldman Sachs boosts productivity firmwide with an AI assistant.

- Capital One invests in AI talent.

- UBS deploys copilots to every employee.

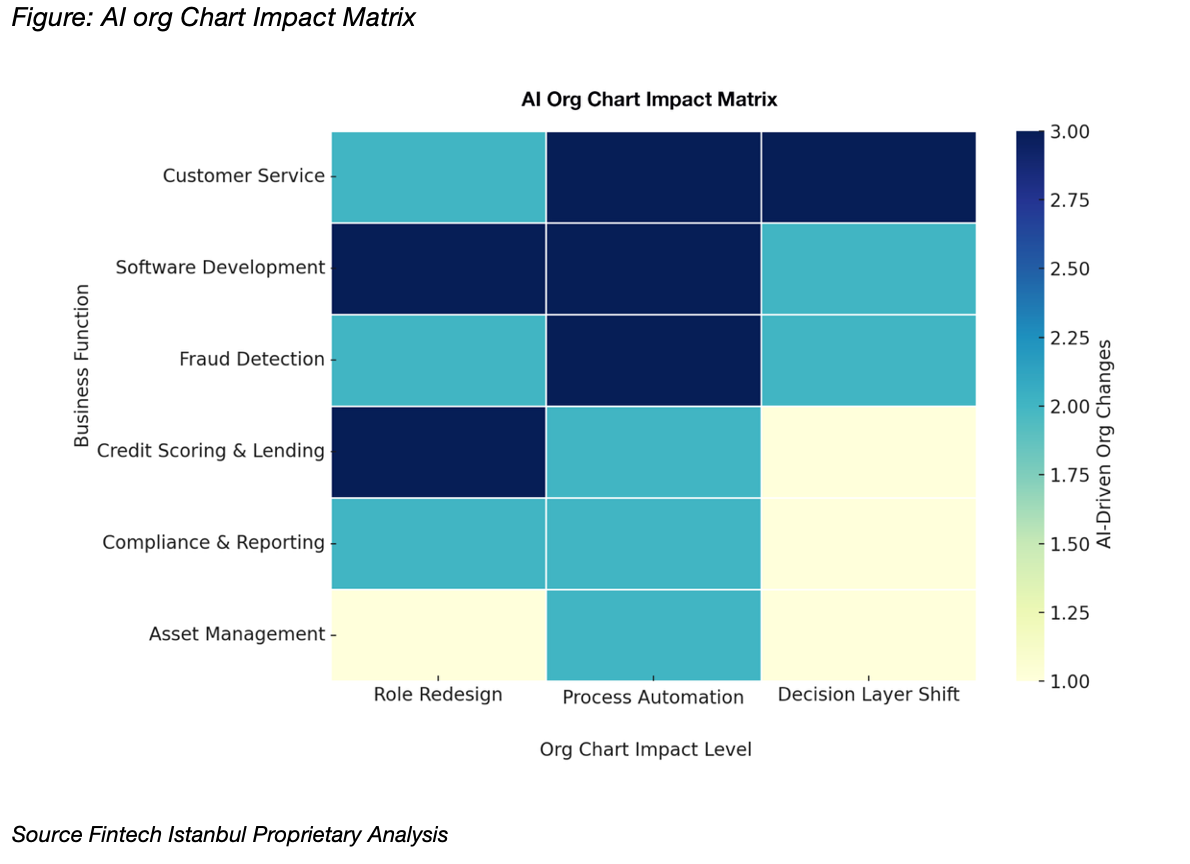

AI Org Chart Impact Matrix

“Visualize how structural impact from AI varies, from minor adjustments in light yellow to major shifts in roles and decision making in dark blue, with leading examples such as HSBC, Bank of America with Erica, and UBS with copilots illustrating the full spectrum.””

- Data as the New Strategic Asset

Success in AI now hinges on the scale, diversity, and ownership of financial data.

- Upstart leverages 91 million repayment records,

- Lemonade draws on a decade of policyholder information,

- Workday trains on one trillion enterprise transactions.

This shift moves competitive advantage from generic models to ecosystem control and data quality—creating moats that are difficult for rivals to replicate.

- AI in Action: How Applications Are Transforming Finance

The table below summarizes how AI is integrated across key financial applications, driving efficiency, security, and innovation.

Table: Key AI Applications and Measured Outcomes in Financial Services, H1 2025

| Application Domain | Key Use Case | AI Capabilities | Representative Companies | Notable Outcomes |

| Fraud Detection & Cybersecurity | Real-time anomaly detection, threat prevention |

ML for pattern recognition, GenAI for simulations, federated learning, explainable AI |

Visa, Mastercard, American Express, Hawk AI, Order.co, Ascent, HSBC, |

Majority of fraud eliminated vs manual entry (Visa), 6% fraud detection accuracy(Amex) |

| Credit Scoring & Lending |

Fairer, faster lending using alternative data | Predictive analytics, explainable AI, behavioral scoring, GenAI for personalization, compliance GPTs |

Upstart, Zest AI, Scienaptic, CredoLab, Citigroup |

44% more approvals (Upstart), 25% conversion increase (Affirm) |

| Risk Management | Market and operational risk prediction, Basel III, ESG |

Simulation models, NLP for risk reports, topological AI, GenAI for climate and geopolitical risks |

JPMorgan, Workiva, Gradient AI, Ayasdi, Kensho, S&P Global, ICE, |

30% of customers use AI for ESG (Workiva), |

| Algorithmic Trading & Robo-Advisory |

Automated trading, portfolio optimization |

Reinforcement learning, GenAI for strategy simulation, data cleansing, multi-asset analytics |

Trumid, Canoe, Wealthfront, Vanguard |

25% execution improvement (Trumid), 3,400+ alternative investments for 24 clients and process 150,000+ documents (Canoe) |

| Personalized Banking & Customer Service |

Dynamic user interactions and recommendations | Conversational AI, sentiment analysis, predictive personalization, agentic AI |

SoFi, Wells Fargo, Morgan Stanley, Bank of America, Santander, MUFG |

245M interactions handled (Wells Fargo), 90% adoption in assistants (BoA), |

| Asset & Investment Management |

Portfolio advisory, ESG analysis, operational scaling |

GenAI for research, predictive analytics, autonomous agents |

BlackRock, Goldman Sachs, JPMorgan Chase, Fidelity, Vestmark |

$11T+ managed via Aladdin (BlackRock), 12% earnings growth (JPM), GenAI agent deployment (Goldman) |

| Cash Flow, Expense & Accounting |

Forecasting, close automation, spend control |

AI agents for reconciliation, document extraction, workflow AI |

Ramp, FloQast, Trovata |

30% improved accuracy (Trovata), Rule 40 optimization (Ramp) |

| Emerging Areas (Blockchain, Identity, Payments) | Tokenization, programmable payments, secure ID | Blockchain integration, NLP, biometric verification, smart contracts |

Citigroup, Socure, Wealthblock.AI | Tokenized SME lending (HSBC), blockchain fundraising (Wealthblock), stablecoin trials (Citi) |

Source: Fintech Istanbul, Proprietary Analysis

- Organizational & Workforce Transformation

AI-driven change is not only technological—it is organizational:

- Flattened hierarchies: Copilots and automation reduce middle layers.

- Talent shifts: Priority on AI literate staff and reskilling.

- Universal enablement: Examples like UBS show every employee benefitting from AI copilots.

- New decision flows: Decision-making becomes distributed, guided by embedded intelligence.

- Priorities & Outlook for H2 2025 and Beyond

Now that AI is embedded into core financial operations, the next priorities for leading institutions are:

- Advancing data governance and ecosystem partnerships.

- Navigating regulatory convergence and embedding explainable AI.

- Building trust and transparency with customers and stakeholders.

- Scaling AI agents for new products and compliance.

Key Watch Points:

- How quickly will laggards catch up, given the pace of technological change?

- Will regulators keep up with AI’s complexity, particularly around data quality and consumer fairness?

- How will workforce roles evolve as copilots become ubiquitous?

Prediction:

By end of 2025, expect at least half of large banks and fintech companies to operate with AI copilots, fully automated risk and compliance workflows, and majority customer-facing interactions handled by intelligent agents.

- Conclusion

The core shifts underway across organization, technology, and strategy are both lasting and accelerating. For leaders, now is the time to adapt by investing in data capabilities, building AI first teams, and preparing for continuous restructuring as intelligence becomes the new backbone of finance.

Guest Author: Engin Çağlar

Advisor at Old School GmbH

Founder Context Elite Project

Zug-Switzerland